Medicare is fraught with enrollment periods and important deadlines to remember. There’s the Annual Enrollment Period (AEP), the Open Enrollment Period, and all of the personalized dates that you need to know when you enter Medicare. If you’re like most people, it’s hard to keep up with all of it. In this article, we’ll outline the following Medicare periods you may need to know about:

- Annual Enrollment Period

- Open Enrollment Period

- Initial Enrollment Period

If you have a Medicare question, please give Delta Medicare Benefits Group a call at 901-460-7220. We look forward to helping you navigate your healthcare benefits.

What Is the Medicare Annual Enrollment Period?

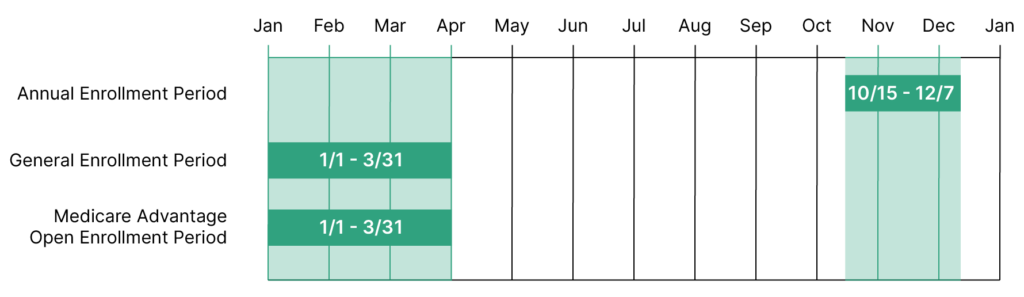

The Annual Enrollment Period, also known as AEP, happens yearly from October 15 to December 7. This period applies to Medicare Advantage recipients and people who may want to change their Part D Drug Plans. In this section, we’ll answer frequently asked questions about the Medicare Annual Enrollment Period.

What Specific Changes Can I Make During Medicare AEP?

During AEP, Medicare beneficiaries can take a few actions, and which actions they can take depend on their current coverage. Those who currently have Original Medicare (Parts A and B) can take the following actions during AEP:

- Switch to a Medicare Advantage plan

- Enroll in a stand-alone Part D plan

- Switch from one Medicare prescription plan to another

- Drop prescription coverage completely (note that if you later need to re-enroll in a prescription plan, you may be charged a penalty; be sure to speak with your Medicare advisor to know which route is best for you)

For those who are already enrolled in a Medicare Advantage plan, also known as Medicare Part C, the following changes can be made during AEP:

- Switch to a different Medicare Advantage plan

- Leave your current Medicare Advantage plan to go back to Original Medicare

- Enroll in a stand-alone prescription plan if you decide to switch back to Original Medicare or if your current Medicare Advantage plan did not include a drug plan

- Disenroll from drug coverage completely (note that you may be charged a penalty if you need to re-enroll down the road)

Compare the differences between Original Medicare and Medicare Advantage here.

What Are Some Reasons to Take a Look at Your Medicare Benefits During AEP?

Regardless of the route you decide to take, it’s a good idea to take a look at your Medicare Advantage plan during AEP every year. Note that Delta Medicare Benefits Group checks all of our clients’ plans to ensure they are getting the most out of their Medicare coverage yearly.

Some reasons you may decide to change your plan during AEP include:

- Your prescriptions costs have increased in your current plan

- Your preferred providers are no longer in your network

- Your healthcare needs may have changed – a different plan may have better coverage considering your current healthcare needs

- Your premium may have increased – changing plans could lower your premium

It’s wise to take note of your changing healthcare and financial situation every year, and plan your Medicare policy updates accordingly.

What Is the Medicare Open Enrollment Period?

The Medicare Open Enrollment Period, also known as OEP, happens yearly from January 1 to March 31. This period applies to those already in a Medicare Advantage plan. During this time, beneficiaries can make the following changes to their plans:

- Make changes to your existing Medicare Advantage Plan

- Switch to a different Medicare Advantage plan – with or without drug coverage

- Drop your Part C to return to Original Medicare. If you do this, you will also be permitted to join a prescription drug plan

- Add or drop drug coverage to your Medicare Advantage Plans

OEP can be a good option for Medicare Advantage recipients who missed taking action during AEP.

What Is the Medicare Initial Enrollment Period?

Americans who are nearing the Medicare eligibility age of 65 should take note of their Initial Medicare Enrollment Period (IEP). This period is personalized to the recipient based on their birthday. IEP is a 7-month period that starts 3 months before the month you turn 65, includes your birth month, and lasts 3 months following your birth month. We’ll answer some frequently asked questions about IEP below.

How Can I Best Prepare for my IEP?

We’ve put together an eBook that explains the ins and outs of Medicare called “Medicare for Beginners.” You can download a free copy at this link. Learning about the various parts of Medicare, how you might want to receive your benefits (via Original Medicare, Original Medicare + a Medigap Plan, or a Medicare Advantage Plan), and having some knowledge about other important Medicare details is a good starting point. You can learn these things if you download our eBook or attend a free Memphis Medicare seminar (call us to register for our next seminar).

If you would like to register for one of our upcoming Medicare Seminars, please give us a call at 901-460-7220 or email us at info@deltabenefitsgroup.com. We’ll walk you through everything you need to know about Medicare in a 45-minute seminar and answer your questions in real-time.

When Will My Medicare Benefits Start After My IEP Enrollment?

When your benefits start will depend on when you enroll during your IEP. Here’s a quick general guide to understanding your coverage start date:

- If you enroll in Medicare before your turn 65, you will receive your benefits the month you turn 65

- If you wait until the month you turn 65 to enroll, your benefits will commence the following month

- If you wait to sign up during the last 3 months of your IEP, your Medicare benefits will start 2 – 3 months after you turn 65

Am I Required to Enroll in Medicare When I Turn 65?

Medicare enrollment at 65 is not a requirement, but unless you have creditable medical coverage, you may receive significant penalties for waiting to enroll.

Creditable coverage may come from your employer or another type of healthcare plan. Note that the following types of coverage are NOT considered creditable medical coverage:

- COBRA

- VA Benefits

- ChampVA

- Tricare

- Federal Employee Health Benefits (FEHB)

- Retiree insurance

Part A is free for most people, so enrolling in Part A and delaying your Part B coverage is something to consider if you have creditable coverage from another provider. In this case, Medicare would act as a secondary or primary coverage, depending on your employer coverage.

Contact Our Medicare Advisors Today

Do you have more questions? Stay tuned for part II of our Important Medicare Dates series where we will review the General Enrollment Period and the Special Enrollment Period. You may also give our Medicare consultants a call today at 901-460-7220. You may also fill out this convenient and secure online form, and we will reach out to you.

In the meantime, check out our website and blog for informative Medicare and healthcare content: