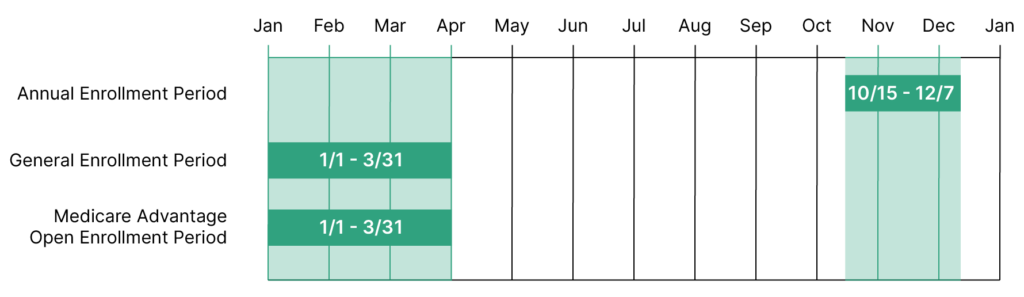

Last week, we posted an overview of important Medicare dates to remember every year. There are so many that we had to write a “Part II.” To read about three important Medicare dates that you should put on your calendar, click here for Part I. In Part II, we’re discussing two more important Medicare dates:

- General Enrollment Period (GEP)

- Special Enrollment Period (SEP)

These periods won’t apply to every Medicare beneficiary, but if you’ve missed your Initial Enrollment Period (IEP) or you need to enter into a Medicare plan after a special event, such as leaving your group coverage or moving across the country, this article may help you understand your next steps.

If you have any questions about your Medicare benefits, give our Memphis Medicare advisors a call today at (901) 460-7220. You may also fill out this convenient and confidential online form.

Note that our main office is located in Memphis, TN, and we serve clients nationwide.

What Is the General Enrollment Period?

The Medicare General Enrollment Period, also called GEP, happens yearly from January 1 to March 31. The GEP is a time for people who have missed their Initial Enrollment Period (that 7-month period dictated by the month of your 65th birthday when you can first enroll in Medicare coverage). To read more about how to enroll in Medicare, please visit this blog that details the enrollment process.

Will I Be Penalized for Waiting to Enroll During GEP?

While Medicare allows a secondary enrollment period in the GEP, beneficiaries should know that they may still incur penalties for the late enrollment. If you don’t sign up for Medicare during your Initial Enrollment Period, you may incur a 10% penalty as a result of not signing up for Medicare Part B. Part B late penalties are calculated at 10% for every 12-month period you would have had Part B. This penalty will be added to your Part B premium once you do sign up, and you will be responsible for the extra percentage for the remainder of your Part B coverage.

Very rarely will people have to pay a penalty on Part A if they do not enroll in time. Most people qualify to receive premium-free Part A – this, typically, has to do with how many quarters a beneficiary or his/her spouse has worked and paid into Social Security. People eligible for Railroad Retirement Benefits may also qualify for premium-free Part A. When you don’t meet these qualifications for premium-free Part A, you will have to pay a monthly premium. If you don’t enroll in Part A and don’t qualify for premium-free Part A, you may have to pay a 10% penalty. You’ll have to pay this increased premium for twice the number of years you didn’t enroll in Part A.

Finally, not enrolling in Part D on time may also result in a penalty once you do sign up for drug coverage. You may be responsible for the Part D late-enrollment penalty if, at any time after your Initial Enrollment Period, there is a period of 63 consecutive days or more when you don’t have Medicare drug coverage or other creditable prescription drug coverage. You’ll generally have to pay the penalty for as long as you have Medicare drug coverage.

The penalty you’ll have to pay will depend on how long you went without Part D or creditable drug coverage. Medicare uses a special equation based on the “national base beneficiary premium,” which is $33.37 in 2022. They take 1% of this amount and multiply it by the number of full, uncovered months you didn’t have Part D or creditable coverage. The monthly Part D penalty you’re responsible for is then rounded to the nearest $0.10 and tacked onto your monthly Part D premium. Because Medicare utilizes the national base beneficiary premium to calculate the Part D penalty, your amount could change every year. We know this is confusing! Here is the example Medicare.gov gives to explain this equation:

Mrs. Martinez has Medicare, and her first chance to get Medicare drug coverage (during her Initial Enrollment Period) ended on July 31, 2018. She doesn’t have prescription drug coverage from any other source. She didn’t join a Medicare drug plan by July 31, 2018, and instead joined during the Open Enrollment Period that ended December 7, 2020. Her Medicare drug coverage started January 1, 2021.

Since Mrs. Martinez was without creditable prescription drug coverage from August 2018–December 2020, her penalty in 2022 is 29% (1% for each of the 29 months) of $33.37 (the national base beneficiary premium for 2022) or $9.68 each month. Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan’s monthly premium.

Here’s the math:

.29 (29% penalty) × $33.37 (2022 base beneficiary premium) = $9.68

$9.68 rounded to the nearest $0.10 = $9.70

$9.70 = Mrs. Martinez’s monthly late enrollment penalty for 2022

Note that if you meet the criteria to enroll during a Special Enrollment Period, you may not have to pay these penalties. We’ll discuss more on this in the SEP section below.

What Is the Special Enrollment Period?

The Special Enrollment Period, also known as SEP, may provide some relief to those who have not enrolled in Medicare on time in terms of penalties. In some cases, if you meet certain SEP criteria, you may be exempt from paying the penalties discussed above. These criteria account for special circumstances that may have reasonably delayed your enrollment or necessitated a change in your benefits. Some examples of these special circumstances that allow you to enroll or make changes during an SEP include:

- Leaving your group coverage

- You move to a different area of the country

- You move back to the United States after living outside the country

- There is a declared disaster, such as a hurricane

There are a few reasons that you may be eligible to enroll during a SEP. For a full list and explanation of the actions Medicare allows you to take, click on this link.

Contact Our Medicare Advisors About Your Enrollment Options

If you believe you qualify for a SEP or have questions about GEP or other Medicare dates, please give our Medicare advisors in Memphis a call at (901) 460-7220. Note that our main office is located in Memphis, and we provide Medicare services throughout the United States.

For more updates on Medicare and insurance benefits, follow Delta Benefits Group on YouTube by clicking this link.