As your sixties approach, your overwhelm over all the things you need to know in the coming years typically increases. There’s retirement planning, estate planning, and the ever-daunting enrollment into Medicare. The good news is that when you take the right steps Medicare, in reality, is a lot less daunting than it may initially seem. In this blog, we’ll discuss the 3 important steps to navigating your Medicare enrollment and benefits.

We hope our content helps you better understand your Medicare and insurance options. If you have remaining questions, please reach out to our team of Medicare experts at (901) 460-7220. Alternatively, you may fill out our convenient and secure online form located here.

1. Get the Basics of Medicare Down

It’s our mission to help you genuinely understand your Medicare benefits so that you can more easily navigate and optimize your plan based on your individualized healthcare and financial needs. We keep our clients updated with informative content, including Medicare tips, need-to-know deadlines, important updates, and more. You can follow our helpful content a few different ways, depending on your learning preferences:

- Follow our blog if you would like to read informative articles to understand the ins and outs of your health insurance coverage – browse our blog by clicking this link.

- If you are more of a video learner, we produce weekly videos on important Medicare topics over on the Delta Medicare Benefits Group YouTube channel, which you can find at this link.

- To ensure you see our updates – both in article and video form – subscribe to our email list by sending us an email request to info@deltabenefitsgroup.com.

- Register for one of our Medicare seminars by calling us at (901) 460-7220

- Download our free eBook, Medicare for Beginners, at this link.

Now that you know where to find our helpful and informative content to do some research and stay updated on the latest with Medicare, let’s talk about the general things you need to know about Medicare when it’s time to enroll.

You Are Medicare-eligible at 65

Most people know that 65 is the magic number to enroll in Medicare, but there are a lot of nuances you may want to know about when it’s time to enroll. The point at which you are officially eligible to enroll in your Medicare benefits depends on your birthday, and your Initial Enrollment Period (IEP) is based on this. Your IEP is a 7-month period throughout which you can complete your enrollment. This period includes the 3 months before your birth month, your birth month, and the 3 months prior to your birth month.

Read more about Medicare enrollment at this link.

There Are a Few “Parts” You Should Know About

Original Medicare consists of Parts A, B, and D. Because there are gaps within Original Medicare, many people supplement their coverage with a Medigap plan (more on this below). Each part will cover specific healthcare services.

Some examples of the services Medicare Part A covers include:

- In-patient hospital stays – Part A covers care received when you are admitted to the hospital. Part A covers you for up to 90 days in the hospital each benefit period, plus 60 lifetime reserve days. Psychiatric hospital stays are also covered by Medicare for up to 190 lifetime days.

- In-patient surgery – Surgery performed while you are in the hospital is covered under your Part A coverage.

- Skilled nursing facilities (SNF) care – To qualify, you must have spent a minimum of 3 consecutive days in in-patient hospital care, within 30 days of admission to SNF care. Medicare will pay 100% for the first 20 days of SNF care. From days 21 – 100, you’ll pay $194.50 per day (2022 costs).

- Hospice care – If your doctor determines you are terminally ill, you can elect to use this coverage. Hospice is covered for as long as your healthcare provider determines you need care.

- Lab tests – Labs taken while you are in the hospital in in-patient care are covered under Part A.

- Home health care – Part A and/or Part B may cover this.

Some examples of the services Medicare Part B covers include:

- Medically Necessary Outpatient Services – A service will be determined as “medically necessary” if it is needed to effectively diagnose and treat a health condition. Some medically necessary services include doctor office visits.

- Durable Medical Equipment – This includes wheelchairs, crutches, home hospital beds, diabetic supplies, etc.

- Preventive Services – This includes services that help prevent illnesses, like the flu, or detect illnesses at earlier stages when treatment is most likely to be more effective.

Finally, Medicare Part D covers your drugs. We’ve got an entire blog on the topic, which you can read at this link.

You Can Receive Your Benefits A Couple of Ways

You can choose to receive your Medicare benefits in two ways: via Original Medicare, as mentioned above, or via Medicare Advantage. There are a few key differences between the two ways that you’ll need to know. Read our blog post on the topic here. Note that this information is also in our eBook, Medicare for Beginners, if you’ve downloaded it to read later. Download the book here.

If you want a complete Medicare 101 course, we urge you to sign up for one of our free Medicare seminars, which we offer in person or online. To reserve your seat at the next seminar, call us at (901) 460-7220.

2. Know What You’ll Pay for Your Medicare Benefits

While Medicare is generally less expensive than other forms of health insurance coverage, there are still costs associated with your benefits. This surprises some people, but it’s important to understand your Medicare budget. Depending on the route you go in choosing Medicare Advantage or Original Medicare with or without a Medicare Supplement, your budget will look different. A knowledgeable Medicare advisor can help you determine which plan may be right for you depending on your specific circumstances. Generally, you’ll need to pay attention to the following costs, regardless of how you receive your Medicare benefits:

- Medicare Part B Premium

- Costs for Part D

Part B Premium Costs

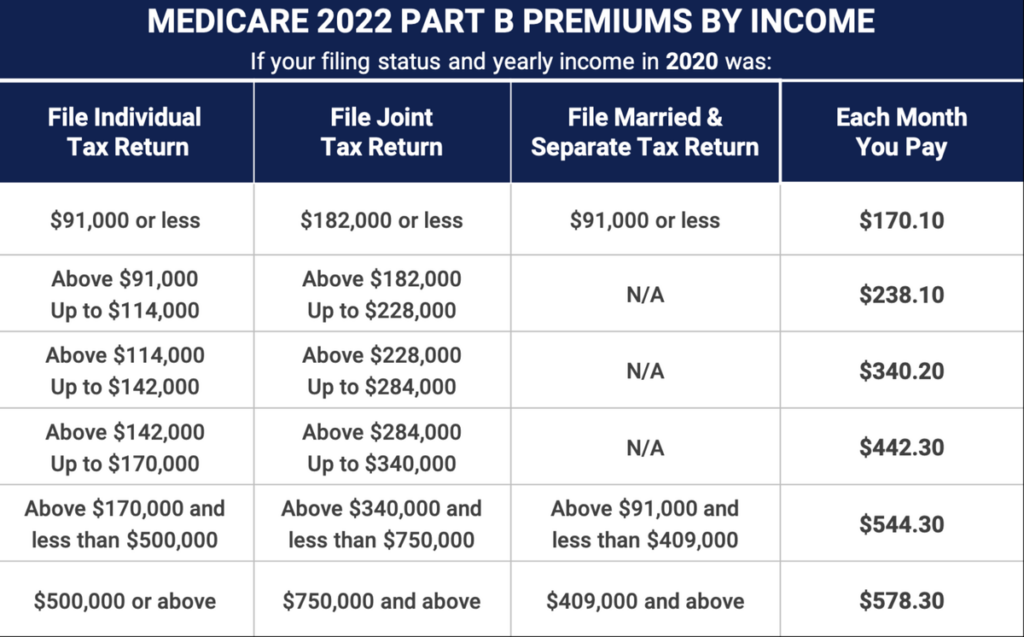

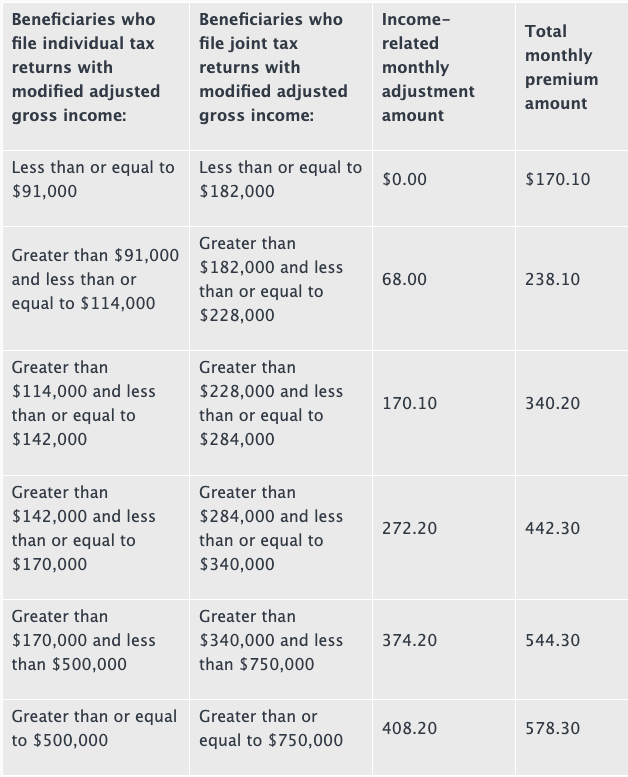

This changes yearly. In 2022, the Part B premium for most people is $170.10/month. Medicare recipients in higher income brackets pay a higher premium (see chart below). This higher premium is determined by your taxable income two years prior. Know that once you begin receiving social security benefits, your Part B premium will be deducted from your social security check.

Part D Costs

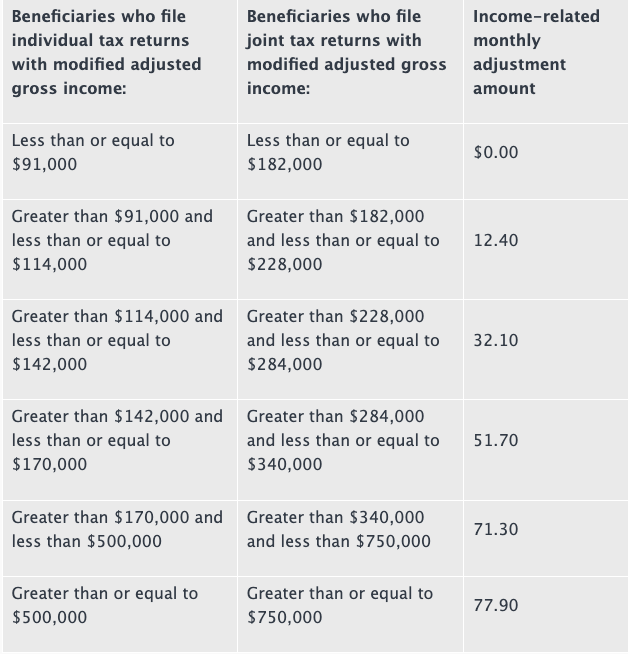

Another cost to be aware of when you’re on Medicare is your Part D coverage. Your Part D premium costs will depend on various factors, such as your location, the types of medications you’re on, etc. The average Part D monthly premium is around $30/month currently. Note that your premium for Part D may also be higher depending on your income, similar to the Part B premium (see chart below).

3. Plan for the Gaps in Original Medicare

Medicare inherently has gaps in its coverage. This is why Medicare supplemental coverage (Medigap plans) is so popular. Some gaps you’ll want to be aware of in your Medicare coverage include:

- Gaps for extended hospital stays – Part A will cover the first 60 days in the hospital. You will pay a hospital deductible of $1,556 (in 2022). After the first 60 days in the hospital, you will begin to pay a larger share of the costs. This share can end up being very costly, adding up daily. A Medigap plan could protect you from these large costs.

- Gaps in Part B coverage – After a deductible of $233 (in 2022), Original Medicare will pay 80% of Part B outpatient services, such as surgical procedures, radiation, chemotherapy, durable medical equipment, etc. Depending on your health situation, your 20% can add up quickly as there is no cap on the 20% you will be responsible for paying. Medicare supplements could protect you from this.

Depending on your specific health and financial situation, looking into a supplement may be the right move for you. Similarly, looking into Medicare Advantage may be the right option for you. Medicare Advantage plans often have lower premiums than Medigap plans. The tradeoff is you will likely still owe copays and other costs that you may not with a Medigap plan. The best option is highly dependent on your specific situation. A Medicare consultant can help you understand what the best route may be for you.

Schedule a Call with Our Medicare Advisors Today

Delta Medicare Benefits Group exists to help Medicare recipients better navigate their benefits. We look forward to answering any insurance questions you may have. Schedule a free consultation with us today by calling (901) 460-7220 or filling out our online form at this link.