Numbers updated for 2022

This week, we’re covering Medicare Part D. If you have prescriptions, as many of us do, you likely have questions about how Medicare covers your medicine. In this article, we’ll discuss what you need to know about your prescription benefits, including what does Medicare Part D cover, how much it costs, how it works with your Medicare benefits, and more.

If you have remaining questions, please give us a call at (901) 460-7220, send us an email at info@deltabenefitsgroup.com, or fill out our convenient online form. We’re happy to answer any of your Medicare questions free of charge.

Medicare Part D Basics

Medicare Part D covers prescription drugs. There are a few ways Medicare Part D is offered:

- Through private insurance companies as standalone plans

- For those enrolled in Original Medicare

- As a set of benefits included in your Medicare Advantage plan

Each Medicare Part D plan has its own list of prescriptions which it covers called a “formulary.” Many Medicare prescription plans place medications in different tiers within formularies. If your medication is not included on the formulary or in a higher tier than you expected, you may request an exception, pay out-of-pocket, or file an appeal. For information on how to do this, call Delta Medicare Benefits Group. One of our dedicated Medicare consultants will help you understand where your prescription falls and how to potentially get it covered under your plan if it is not within your formulary.

How Much Does Part D Cost?

Part D premiums vary based on your specific plan, your insurance provider, your location, the prescriptions you take, and your income from two years before the year you enroll in Part D. Our Medicare experts can help you determine your exact Part D premium.

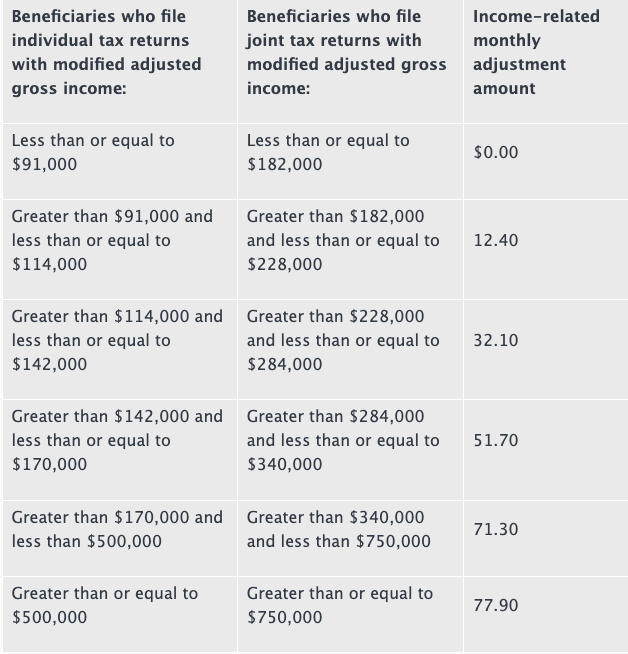

People who make higher incomes may pay more for their premiums. This is called the Income Monthly Adjusted Amount (IRMAA). The chart below shows what your 2022 premium may be according to your 2020 income.

Ensure you enroll in Part D on time or have creditable drug coverage (insurance that is comparable to Part D), as failure to do so may result in late-enrollment penalties. Late enrollment may also result in coverage gaps.

Part D deductibles and copays will also depend on your plan and insurance provider. Medicare sets a standard maximum deductible that serves as a guideline for all Medicare Part D insurance providers. For 2022, the maximum standard deductible is $480. No insurance provider can charge a deductible higher than the set standard for the year and some insurance companies may offer a lower deductible. Some plans even require no deductible. If your plan does require a deductible, you’re responsible for paying 100% of your prescription drug costs until you meet the deductible. However, there are exceptions to this rule – tier 1 and tier 2 prescriptions are generally exempt from the deductible.

Part D copays will be set by the tier each medication falls into within your plan’s formulary. Typically, Part D plans will have four or five tiers:

- Tier 1 – Preferred generic medication

- Tier 2 – Non-preferred generic medication

- Tier 3 – Preferred brand medication

- Tier 4 and above – Non-preferred brand medication; expensive, specialty prescriptions

Generally, the higher the tier, the higher your copays will be. When you enroll in your plan, a Delta Benefits Medicare consultant can help you review your formulary to ensure your medications are included and determine what your copays will be.

How Do I Know If a Medication Is Covered under Part D?

Your medications will be listed within the formulary associated with your plan. Reviewing that will let you know if your prescriptions will be covered as well as what you will pay for them. Some types of medications are excluded from Medicare coverage by law. These excluded medications are fertility drugs, drugs that are only meant to relieve cold and cough symptoms, non-prescription/over-the-counter medications, etc. Note that some of these medications may be covered if they are also used to treat other conditions. For example, a medication used for cold and cough relief may also treat asthma. The Federal Drug Administration (FDA) must have approved the use of the excluded drug for other treatments to be included on the formulary.

If your prescription drug is not included within your formulary, or in a higher tier, you may request an exception. Delta Medicare Benefits Group can assist you with this.

Medicare Part D Enrollment

If you are 65 years of age or older, you are eligible for Part D Medicare. Though Part D is optional, if you utilize Medicare as your primary coverage, you should enroll in Part D. If you do not enroll within a certain amount of time, you may be subject to penalties or pay higher costs for medications you may need down the line. If you have employer coverage that is comparable to Part D, you can delay enrollment and avoid penalties.

To enroll in Part D, you can call our Medicare consultants at Delta Medicare Benefits Group, go online to www.medicare.gov, or call Medicare directly.

Joining a Part D plan is limited to certain time periods, including:

- Initial Enrollment Period (IEP) – This is when you are first eligible to enroll in Medicare. It includes a 7-month period from 3 months prior to the month you turn 65, includes your birth month, and lasts 3 months following your birth month.

- Annual Enrollment Period (AEP) – This is yearly from October 15 – December 7. During this period, you’ll be able to enroll in or change your Part D plan.

- Special Election Period (SEP) – You are locked into Part D for a full calendar year unless you qualify for special enrollment under certain conditions. Some examples of conditions that may make you eligible for SEP include if you move out of state, lose your group coverage, or live in an area that has experienced a national emergency (like Hurricane Ida).

Learn more about enrollment periods and other Medicare questions on our frequently asked questions page.

Our Medicare Consultants Can Help You Enroll in Part D

Whether you need to change your plan this upcoming AEP (October 15 – December 7), need assistance finding the right Medicare Advantage plan for you, or need help translating your formulary or Part D premiums, Delta Medicare Benefits Group has you covered. Give us a call at (901) 460-7220, send us an email at info@deltabenefitsgroup.com, or fill out our convenient online form. We’re here to help you make sense of your Medicare coverage.

Medicare Part D Premium CMS Chart

Learn your 2022 Premium from your 2020 Income