Medicare Part B makes up a significant portion of your Medicare benefits, and it’s the part that most people do pay a premium on. In this article, we’ll discuss what Part B covers and outline the associated costs updated for 2022.

If you have questions about your Part B coverage or general Medicare benefits, the experts at Delta Medicare Benefits Group are here to help you. Give us a call at (901) 460-7220, or send us an email at info@deltabenefitsgroup.com. We look forward to helping you make the most of your Medicare.

What Does Medicare Part B Cover?

Medicare Part B covers a few significant medical services, including:

- Medically Necessary Outpatient Services – A service will be determined as “medically necessary” if it is needed to effectively diagnose and treat a health condition. Some medically necessary services include doctor office visits.

- Durable Medical Equipment – This includes wheelchairs, crutches, home hospital beds, diabetic supplies, etc.

- Preventive Services – This includes services that help prevent illnesses, like the flu, or detect illnesses at earlier stages when treatment is most likely to be more effective.

Some things that fall into the above categories include ambulance services, occupational therapy, physical therapy, chemo, etc.

What Costs Are Associated with Part B?

There are a few costs associated with Part B, including premiums, deductibles, and copays.

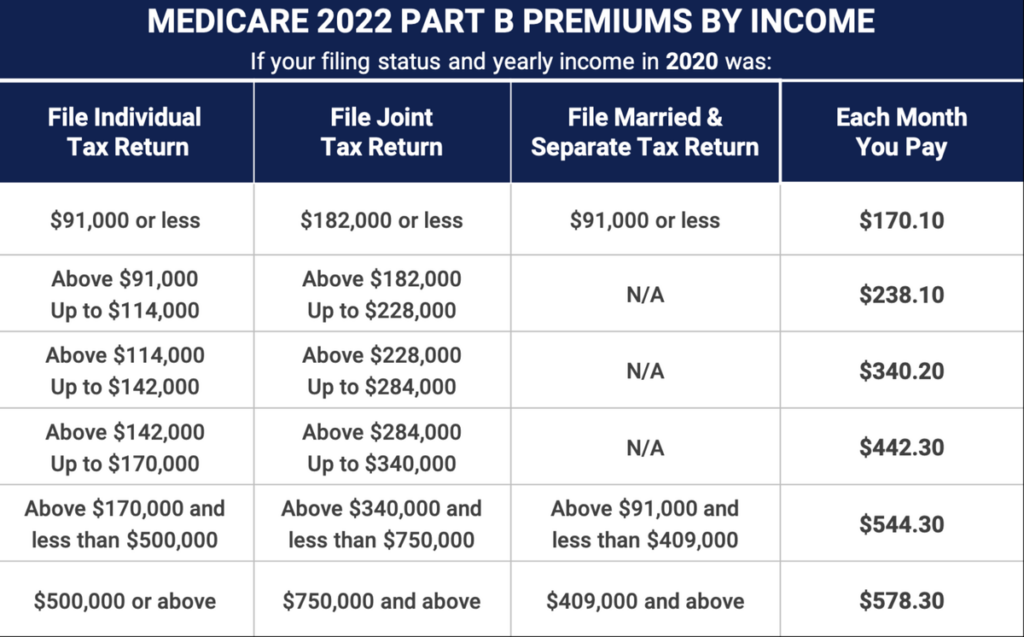

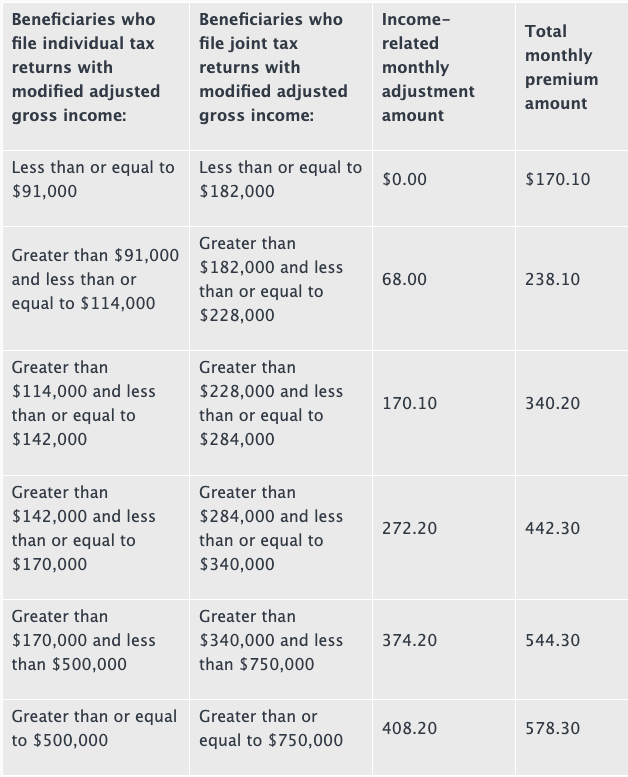

Everyone will pay a Part B premium. The question is how much you will pay for Part B. In 2022, Part B will see a historical and significant increase. Monthly premiums will increase by about $22 to $170.10, which is the amount most people will pay. The annual deductible will jump from $203 to $233 in 2022. If you are in the small group of people who pay more for Part B based on your income taxes from 2020, your premium will also increase next year. The Centers for Medicare (CMS) chart included at the bottom of this page shows the premium increase for higher-income beneficiaries.

After your Part B deductible is met, Medicare will pay 80%. Medicare is different from most health insurance plans in that there is no maximum out-of-pocket cost for which you will be responsible. This means that the 20% of costs you’re responsible for will not be capped. For this reason, we recommend getting supplemental coverage, which will better protect you in the event you have to pay for expensive necessary medical services, like chemotherapy.

Medicare Part B Late Enrollment Penalties

Signing up late for Part B may result in late fees when you do decide to enroll. Typically, you’ll want to enroll in Part B during your Initial Enrollment Period (IEP), which is the 7-month period based on your birthday. Your IEP includes the 3 months prior to your birth month, your actual birth month, and the three months following your birth month. If you don’t enroll on time, your standard monthly premium may increase by 10%. Once you receive a 10% increase, you will have to pay this monthly penalty for as long as you are enrolled in Medicare Part B.

If you are receiving Social Security, you will likely be automatically enrolled in both Parts A and B. If you have to enroll manually, there are 4 ways to do so:

- Before the COVID-19 Pandemic, you could go to your local Social Security office to enroll, however, that is not currently an option

- You can call Social Security at 800-772-1213 to enroll in Part B

- You can also go to ssa.gov/medicare to enroll

- Lastly, you can call Delta Medicare Benefits Group at (901) 460-7220, and our Medicare consultants in Memphis will help you enroll

Questions About Part B Costs

As always, if you have questions about your Medicare benefits, our experts are ready to help you. From enrollment to choosing the right Medicare Advantage plan or supplemental coverage, Delta Medicare Benefits Group is here to help you navigate the confusing and ever-changing world of Medicare. Give us a call at (901) 460-7220 or send us an email at info@deltabenefitsgroup.com.

You can also check out our regularly updated blog or frequently asked questions page for more information.