Having the proper coverage is crucial to fight through any challenge, and that’s where critical illness insurance becomes a great asset. Let’s delve into everything you need to know about this essential asset, how it can safeguard your financial security, and what to expect when finding the solution that works for you.

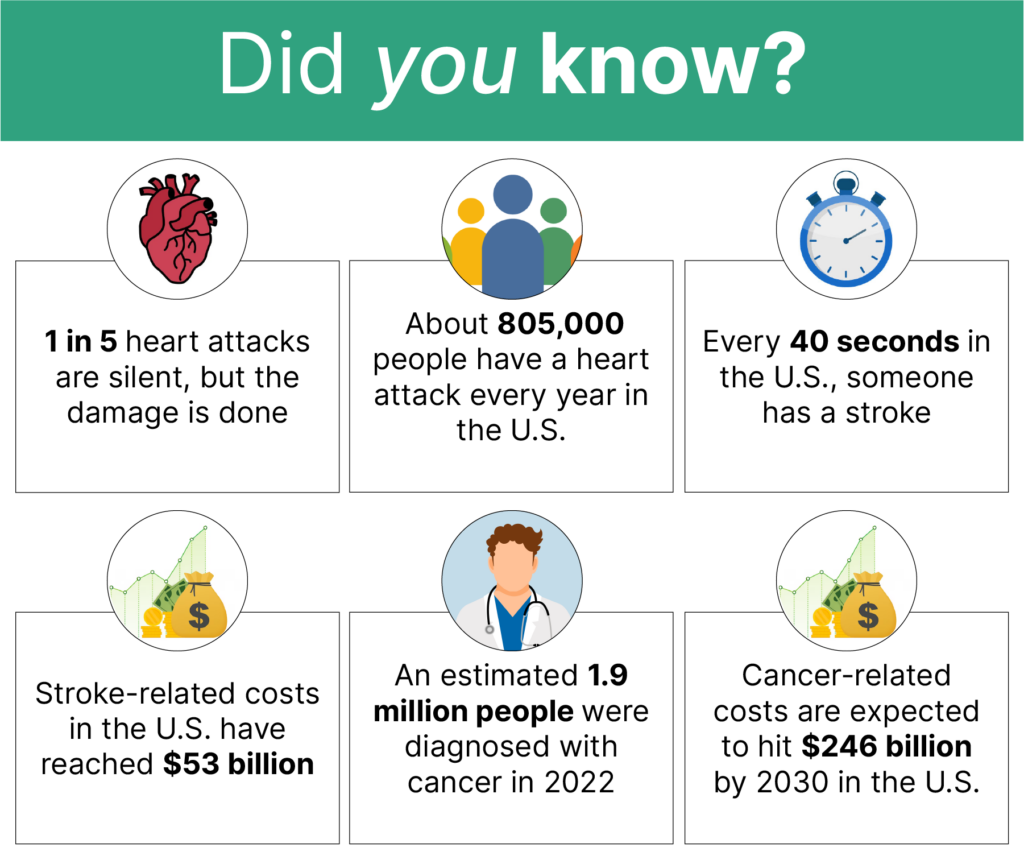

Critical illness insurance provides a lump sum payout to you or your family when you receive a diagnosis of one of the covered conditions specified in the policy. These conditions may include cancer, heart attack, stroke, major organ failure, and many more. By receiving a lump-sum payment upon diagnosis, you can alleviate medical expenses and other debts that accumulate when you cannot work.

Critical illness insurance is relevant for everyone, regardless of age or health status. It ensures the financial security of your entire family in the face of unexpected events. If you’re already receiving Medicare, this type of policy is particularly beneficial. While Medicare provides coverage, there are no guarantees that your cancer, heart attack, or heart disease treatment will be fully covered. Critical illness insurance bridges the gaps in your medical expenses, offering comprehensive protection.

Even if you’re currently healthy, it’s crucial to consider purchasing critical illness insurance because illness can strike unexpectedly. Once diagnosed with a critical illness, obtaining coverage becomes challenging or impossible. Securing critical illness insurance while you’re healthy provides an extra layer of financial security in case of a covered critical illness or disability preventing you from working. This insurance isn’t just for you as an individual; it offers peace of mind to your entire family. Purchasing it early in life ensures a valuable financial asset in the event of a catastrophic illness diagnosis later on.

Critical illness insurance plays a vital role when diagnosed with cancer, heart disease, heart attack, stroke, and more. For individuals on a fixed income, this coverage can lessen the load of medical bills and other expenses that accumulate rapidly during illness.

Critical illness insurance covers over 30 different critical illnesses, including heart attacks, strokes, major organ failure (e.g., kidney failure or liver cirrhosis), cancer, Alzheimer’s, and more. It’s important to review the list of covered conditions before selecting a policy that suits your needs.

The cost of critical illness insurance varies based on factors such as the insurance company, age, number of covered illnesses, and other considerations. Generally, expect to pay around $50 to $100 per month. Critical illness insurance is often more affordable than traditional health insurance because it’s specifically designed to protect you in the event of a severe illness diagnosis.

If you’re looking for a way to help protect your loved ones financially if you are diagnosed with a critical illness or have an accident that leads to disability, talk to us at Delta Medicare Benefits Group. We will help you navigate and compare policies from different insurance companies to find the most affordable and the highest quality critical illness insurance on the market. Contact our team by calling (901) 460-7220 to schedule a free consultation!

By clicking “Next”, you agree to our Terms of Service and Privacy Policy. You also elect to receive updates, newsletters, and offers from Delta Medicare Benefits Group.

By clicking “Next”, you agree to our Terms of Service and Privacy Policy. You also elect to receive updates, newsletters, and offers from Delta Medicare Benefits Group.

Give us a call and get your free consultation today.